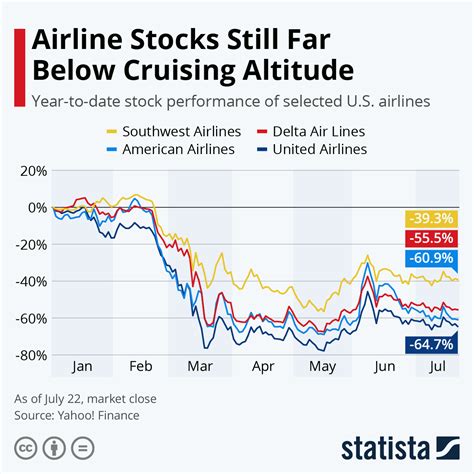

where to buy airline stokcs,Investing in Airline Stocks in 2025 ,where to buy airline stokcs,Some of the top Airlines stocks now: Delta Air Lines Inc (DAL +6.51%), Ryanair Holdings Plc Adr (RYAAY +3.38%), United Airlines Holdings Inc (UAL +7.10%), Southwest Airlines Co (LUV .

Explore the collection of Rolex men's watches and find the perfect timepiece .

Airline stocks are one of the most talked-about sectors in the stock market today. As the world continues to recover from the impact of the COVID-19 pandemic, the aviation industry has experienced a dramatic resurgence. With increasing travel demand, airline companies have seen substantial growth, making them an attractive option for investors. However, like any industry, not all airline stocks are created equal, and understanding which ones to invest in can be a daunting task.

In this guide, we will explore where and how to buy airline stocks, taking into account the best-performing stocks in the market today, key trends in the industry, and expert recommendations for 2025. Whether you are a seasoned investor or a beginner looking to dip your toes into the aviation sector, this article will help you make informed decisions about your investment strategy.

The State of the Airline Industry in 2025

Before diving into the specifics of where to buy airline stocks, it's essential to understand the landscape of the aviation industry in 2025. The sector is currently in a phase of recovery, with travel demand reaching pre-pandemic levels in many regions. Key factors contributing to this growth include:

1. Post-Pandemic Recovery: The airline industry saw a dramatic drop in travel demand during the pandemic, but 2025 marks the industry’s steady recovery. With the vaccination rollout globally and the lifting of travel restrictions, consumer confidence in air travel has returned, leading to higher bookings and increased airline revenue.

2. Rising Fuel Prices: While rising fuel costs are a challenge for airlines, the industry is slowly adjusting to these changes. Airlines that have hedged their fuel prices or implemented more fuel-efficient aircraft are better positioned to weather this storm.

3. Sustainability Initiatives: With growing concern over climate change, many airlines are focusing on sustainability efforts, including carbon offset programs, the use of sustainable aviation fuel (SAF), and more efficient aircraft. These efforts are appealing to environmentally conscious investors and consumers alike.

4. Technological Advancements: Airlines are increasingly leveraging technology to improve customer experiences and reduce operational costs. Innovations like biometric screening, improved in-flight entertainment, and data-driven route planning are becoming standard.

5. Consolidation and Partnerships: The aviation industry continues to see consolidation, as airlines merge to create stronger, more resilient entities. Additionally, international partnerships and alliances (such as codeshare agreements) are expanding, allowing airlines to broaden their reach.

Investing in Airline Stocks in 2025

If you're considering investing in airline stocks in 2025, it's crucial to understand the trends that are shaping the industry. There are several ways to approach airline stocks, including investing in individual airline companies, exchange-traded funds (ETFs), or sector-specific mutual funds.

# 1. Individual Airline Stocks

Investing in individual airline stocks is a common strategy for those who want to directly invest in companies that they believe have strong growth potential. While the major airlines, such as Delta, American Airlines, and United, are well-known, there are smaller and regional airlines that also present compelling opportunities.

Some factors to consider when investing in individual airline stocks include:

- Market Share and Size: Larger airlines tend to offer more stability, but smaller regional carriers often provide higher growth potential.

- Financial Health: Check the airline’s balance sheet, including debt levels, cash flow, and profitability. Airlines with low debt are better positioned to weather economic downturns and unforeseen crises.

- Management and Leadership: Strong leadership is essential, especially in a cyclical industry like aviation. Look for companies with experienced management teams that have a track record of navigating turbulent times.

- Passenger Traffic Trends: Airlines that consistently increase passenger traffic, particularly on profitable domestic or international routes, are more likely to deliver strong returns.

# 2. Exchange-Traded Funds (ETFs)

If you're not interested in picking individual stocks or want a more diversified approach to investing in the airline industry, ETFs can be a good option. ETFs are baskets of stocks that track a specific sector or index, providing exposure to a broad range of companies within the industry.

For example, The U.S. Global Jets ETF (JETS) is one of the most popular airline ETFs, as it includes a mix of major U.S. airlines like Delta, American Airlines, and Southwest, as well as international carriers and aircraft manufacturers. ETFs offer the benefit of diversification, which helps reduce risk compared to investing in single stocks.where to buy airline stokcs

where to buy airline stokcs Tourneau | Bucherer in the United States is proud to be part of the worldwide network of Official Rolex Jewelers, authorized to sell and maintain Rolex watches. Stores; Assistance Call Us 800.348.3332. Schedule a Store Visit. Email Us. Tracking Information. Returns & Exchanges. Shipping & Delivery. Bucherer 1888 Credit Card.Discover the Rolex collection, offering a wide range of prestigious, high-precision timepieces, from Professional to Classic models to suit any wrist.

where to buy airline stokcs - Investing in Airline Stocks in 2025